CUPLAN

SCENARIO PLANNING AND BUDGETING

CUPLAN is the industry’s most flexible and sophisticated tool to create and manage stress scenarios based on interest rate, economic, member behavior, and loan and deposit origination scenarios. CUPLAN is designed from the ground up with flexibility to fit the tactical requirements of small and large credit unions. CUPLAN has unlimited flexibility with respect to the number of variables and scenarios that can be created and stored. CUPLAN also incorporates specific expense and revenue line items and tracks progress on a daily, monthly, quarterly, and yearly basis. Results of planning and budget scenarios can be directly imported into senior management and board reporting packages.

- ALM IQ Scenario Manager has three levels of scenario generation and management capability

- Out-of-the-box scenarios.

- Regulatory reporting and ALCO limits management.

- Custom scenarios

- Regulatory reporting, liquidity management, budgeting stress testing ALCO / Board reporting.

- Advanced scenarios

- Medium- and long-term strategic planning.

- Portfolio acquisitions and divestitures, and mergers.

CUPLAN SCENARIO FRAMEWORK

Scenario and predictive planning are essential tools for credit unions to navigate uncertainties and make informed decisions. Here’s how they can be applied:

- Scenario Planning

- Defination: Scenario planning involves creating multiple plausible future scenarios to prepare for uncertainties. It helps credit unions anticipate risks and opportunities.

- Steps:

- Identify trends and uncertainties (e.g., economic shifts, regulatory changes).Develop scenarios (e.g., best-case, worst-case, and most-likely scenarios).

- Analyze the impact of each scenario on operations, finances, and member services.

- Formulate strategies to address potential outcomes.

- Steps:

- Example: A credit union might create scenarios based on varying interest rate environments to assess their impact on loan demand and profitability

- Predictive Planning:

- Defination : Predictive planning uses data analytics and modeling to forecast future trends and outcomes. It enables proactive decision-making.

- Applications:

- Forecasting member behavior (e.g., loan repayment patterns, deposit trends).

- Predicting financial performance under different economic conditions.

- Identifying potential risks (e.g., liquidity shortages, credit defaults).

- Tools: Credit unions can leverage advanced analytics platforms like Power BI or specialized financial modeling software to implement predictive planning.

Both approaches complement each other, with scenario planning focusing on qualitative possibilities and predictive planning providing quantitative insights. Together, they empower credit unions to remain resilient and adaptable.

CUPLAN SCENARIO PARAMETERS

CUMAN Scenario Manager has three groups of parameters for scenario creation

- Interest rate curve shifts and shocks

- Defination: Scenario planning involves creating multiple plausible future scenarios to prepare for uncertainties. It helps credit unions anticipate risks and opportunities.

- Interest rate curve selections

- Type

- Period

- Maturity/term

- Rate curve shocks

- Parallel shifts

- Flatner / steepner

- All other combinations

- Deposit and loan projections with product-specific fixed and variable rate assumptions

- Deposit origination, surge, maturity and runoff with institution-specific or ALMIQ proprietary beta

- Loan origination and maturity, amortization and prepayments

- Business planning and budgeting

Short/medium/long-term planning with variable/fixed rates, product types, origination volumes and costs, and margins.

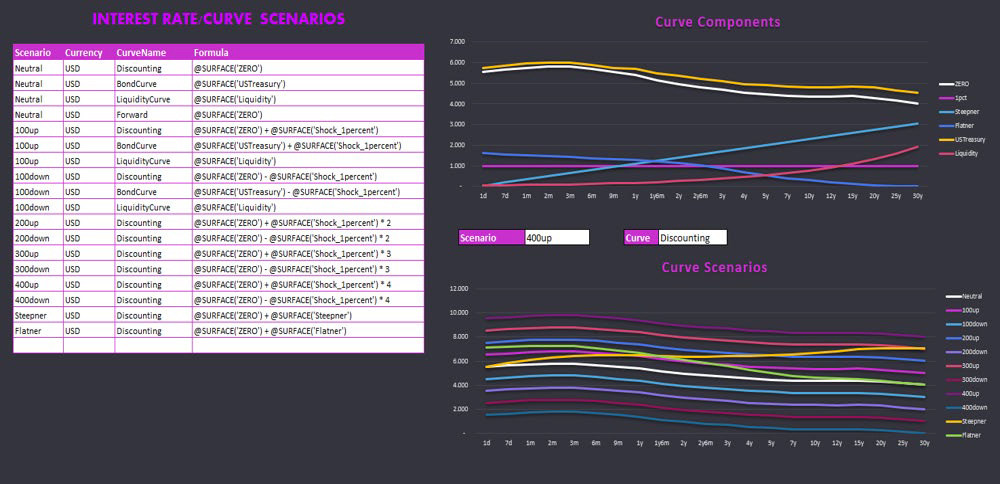

INTEREST RATE SENARIO

Interest rate curve selection

- Type

- Period

- Maturity/Term

Rate curve shocks

- Parallel shifts

- Flatner / steepner

- All other combinations

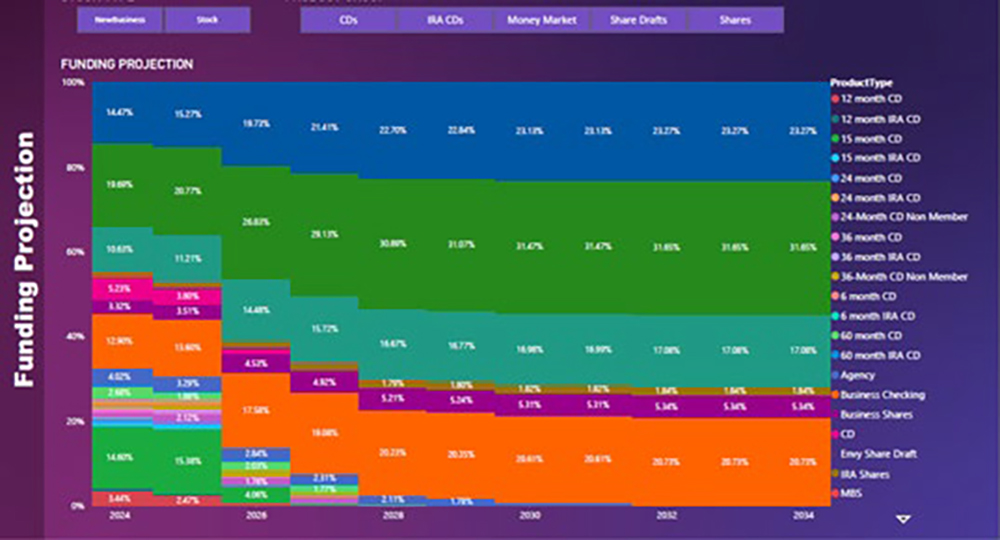

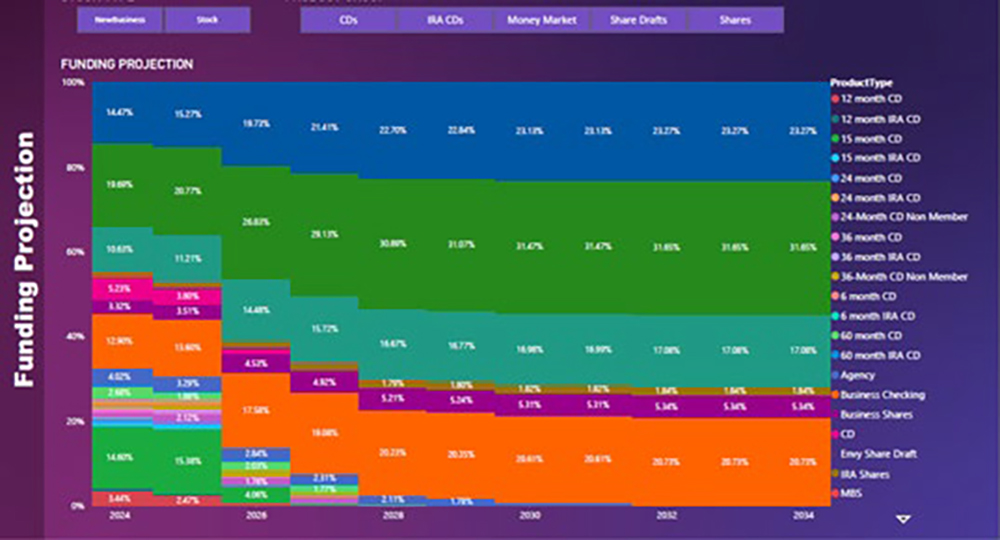

DEPOSIT AND LOAN SCENARIO

- Deposits

- Origination volume, maturity and surge

- Runoff with institution-specific or ALMIQ proprietary beta

- Amortization and prepayments

- Deposit beta

- Deposits

- Loan and investments

- Origination

- Amortization

- Prepayments

CASHFLOW AND COST OF FUNDS

- Cashflow projections

- Loans

- Deposits

- Investments

- Operational Expenses

- Yields and Margins

BUDGETING AND BUSINESS PLANNING SCENARIO

- Deposit/Loan growth

- Rates and margins

- Investment portfolio

- Operational costs

- Risk, income, and capital ratios.

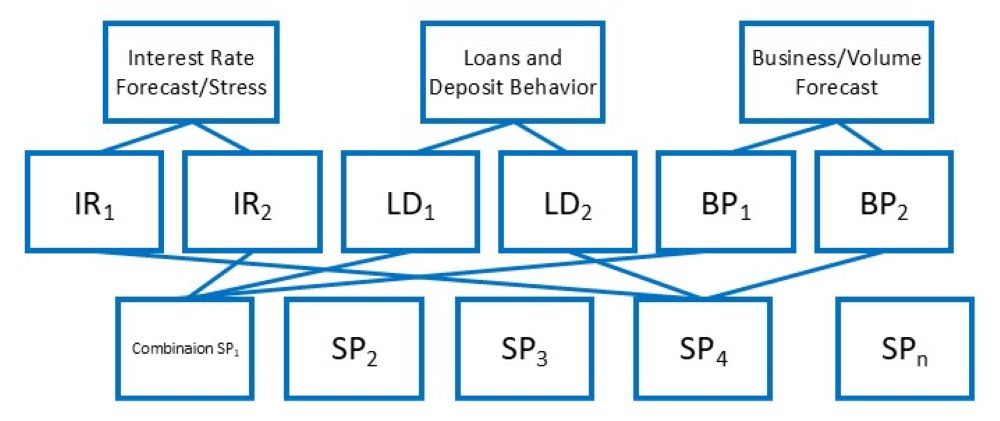

SCENARIO COMBINATIONS

Scenario generation and management is additive

ILLUSTRATIONS OF GENERATIVE SCENARIOS

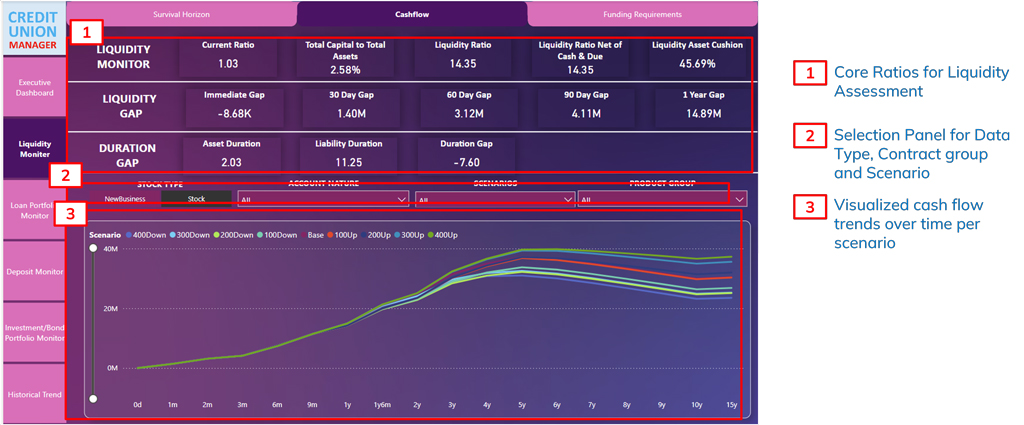

LIQUIDITY STRESS TEST

- Stock Type

- Product Group

- Account Nature

- Cumulative Interest and

- Principal Payment

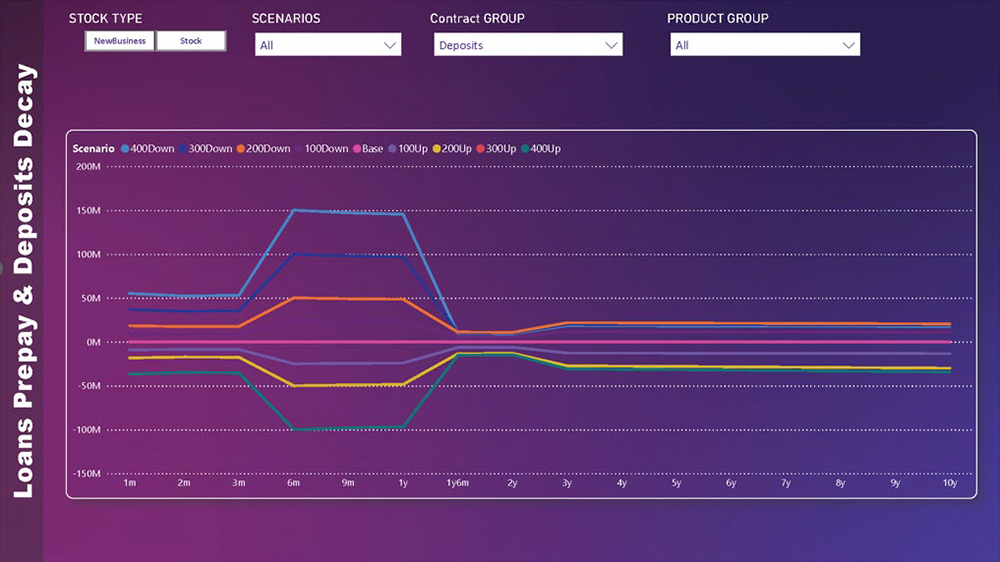

LOAN PREPAYMENT

- Scenario

- Stock Type

- Product Group

- Account Nature

- Prepayment

DEPOSIT DECAY STRESS TEST

- Deposit Type

- Product Group

- Account Nature

- Prepayment

Scenario Planning

Interest Rate Stress Scenario

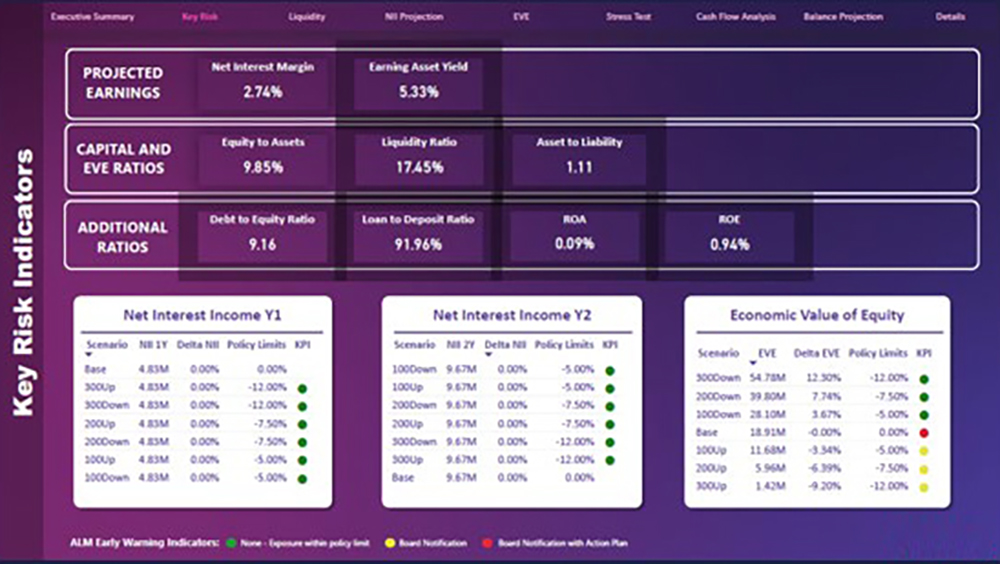

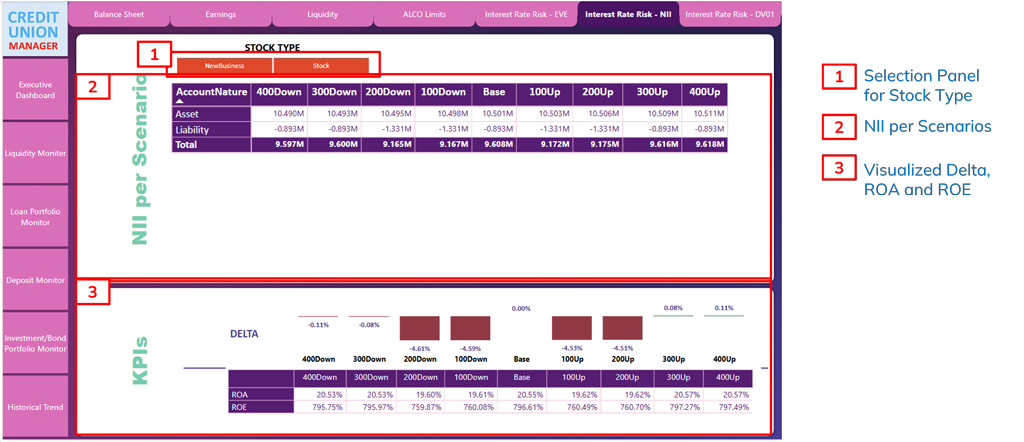

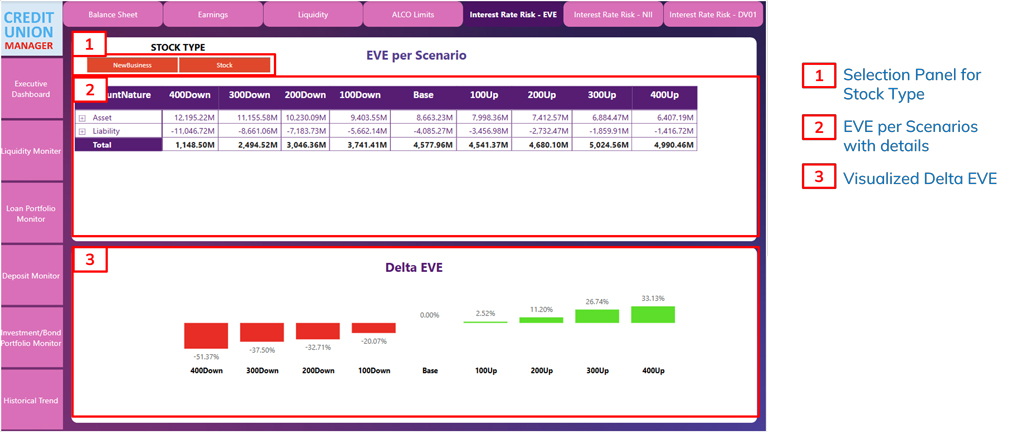

Interest Rate Risk Dashboard

Interest Rate Risk Dashboard

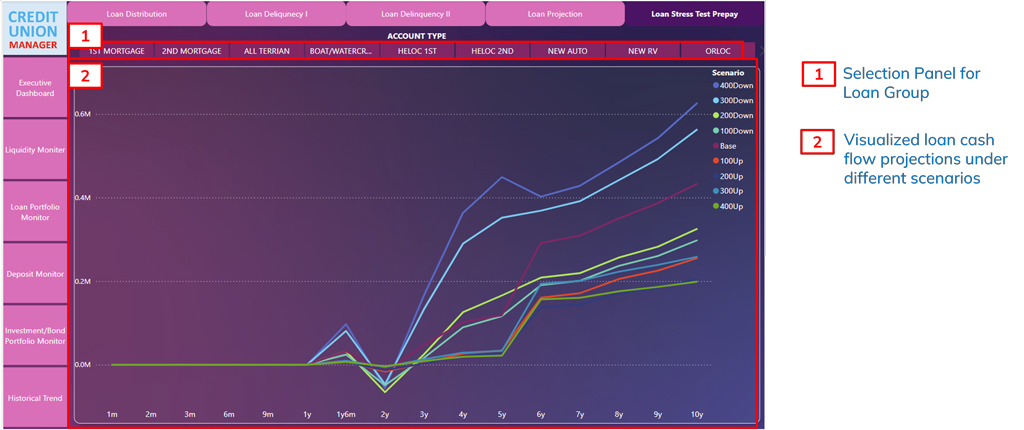

Loan Stress Test Prepay

Loan Portfolio Monitor Dashboard

Deposit Decay Stress Testing

Deposit Monitor Dashboard

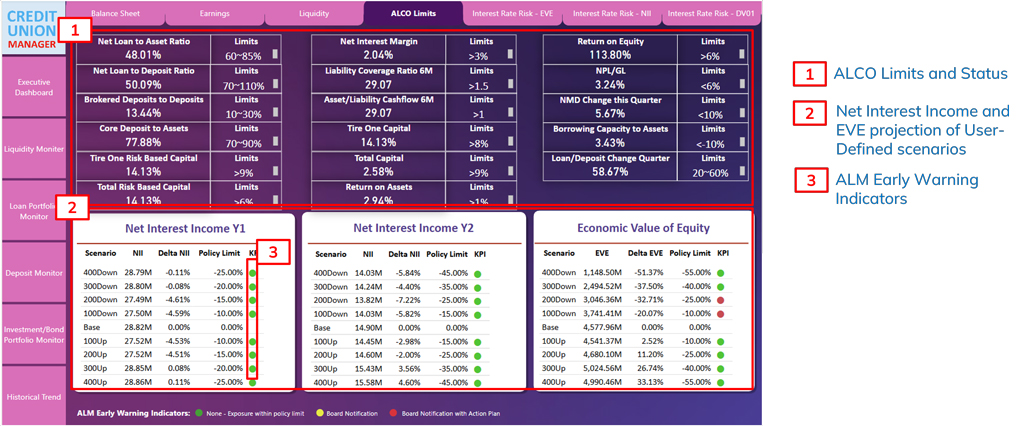

Scenario Analysis and Risk Appetite Setting

Policy Limits Dashboard

Liquidity Monitor Dashboard

Liquidity Monitor Dashboard