Integrated platform for managing financial and credit performance and risk

Most powerful parameter calculation engine used by large banks for decades

Empowers credit union senior managements by enhancing efficiency by 40‑50%

Power Business Intelligence – A state-of-the-art information visualization engine by Microsoft

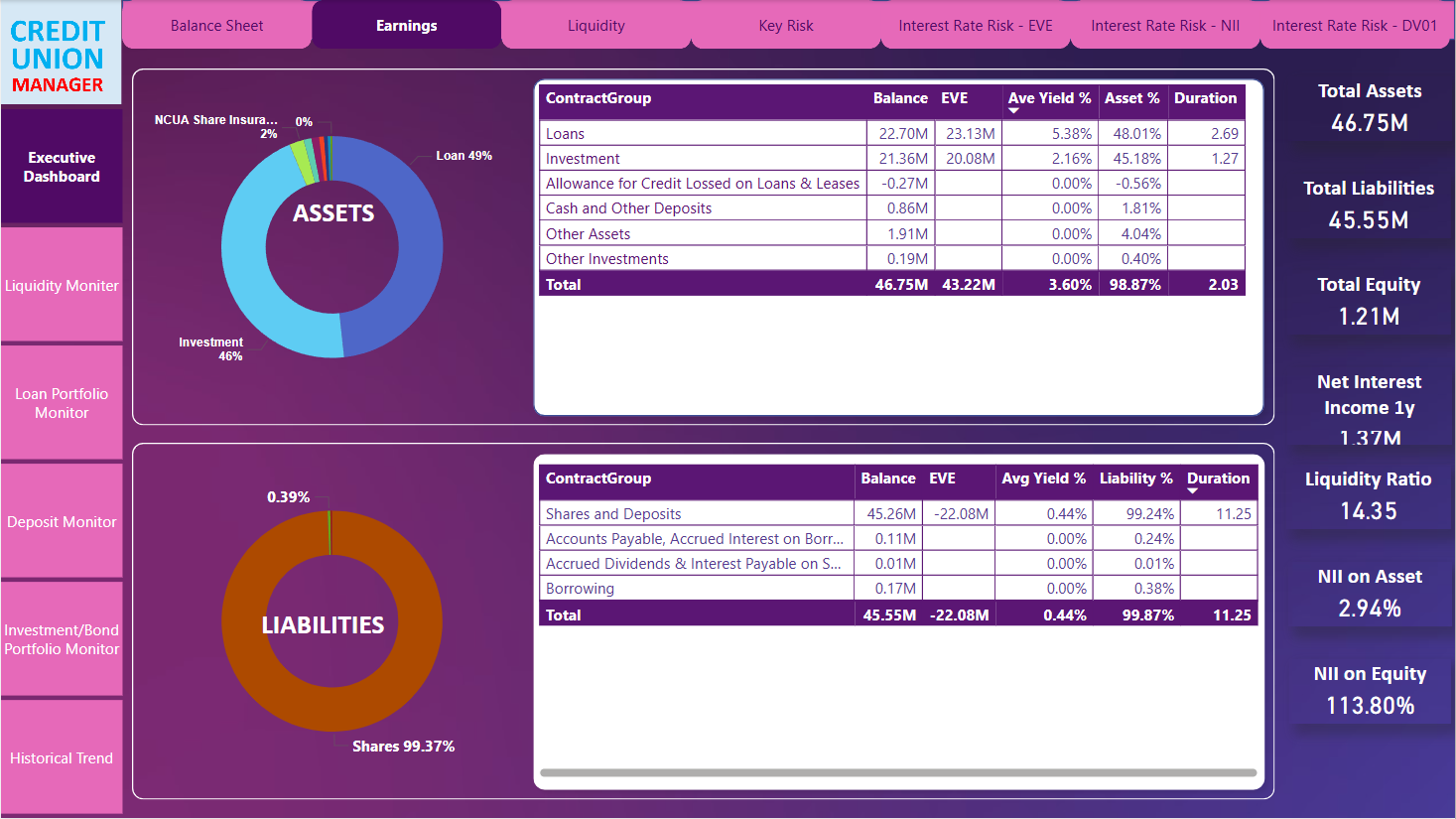

Seamlessly integrates market data, balance sheet, liquidity and credit data

Secure database in Microsoft Azure

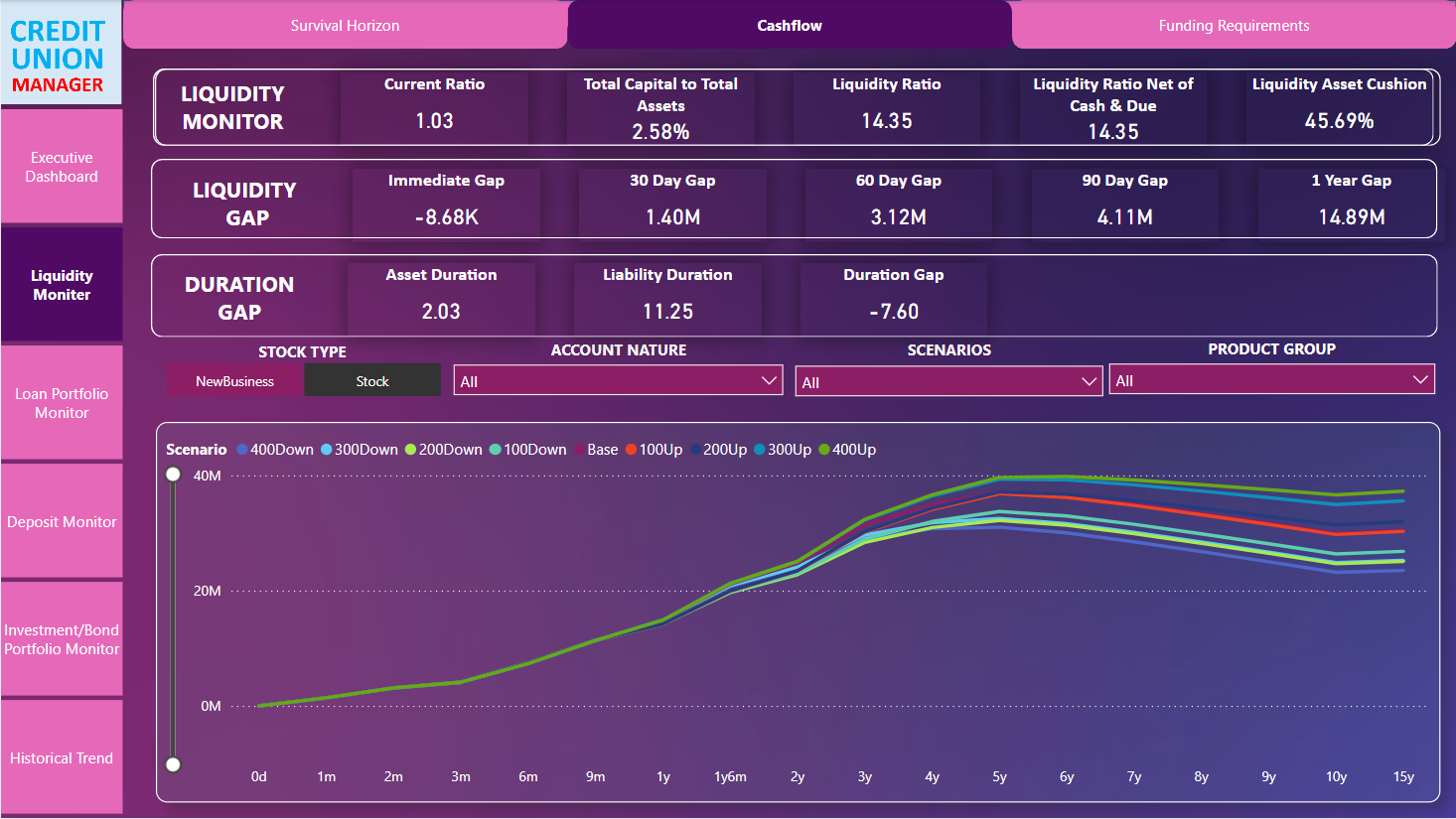

Cutting edge scenario and stress testing with unlimited multidimensional assumption sets

Ease of use – maximum three clicks for every function

Integrated stress test cecl for smoother p&l reporting

Integrated market and peer data

Core system agnostic framework

Integrates with any source databases

Extensive screen and functional customization at institution and user level

“White glove” round the clock service

CUMAN is a unique industry-lending solution created from the ground up for credit unions. It is natively integrated with any core systems and requires minimal effort for implementation, and no ongoing IT support or maintenance.

ROBUST RISK MANAGEMENT

OPTIMAL DECISIONS

CUMAN MODULES

CURISK

UNIVERSAL RISK MANAGEMENT SYSTEM

CECL EXPRESS

RIGOROUS CECL RESERVE COMPUTATION ACROSS ALL METHODS

KEY FEATURES

- Minimal Implementation Effort

- AI-enabled process with anomaly detection

- Multiple Layers of Data Security

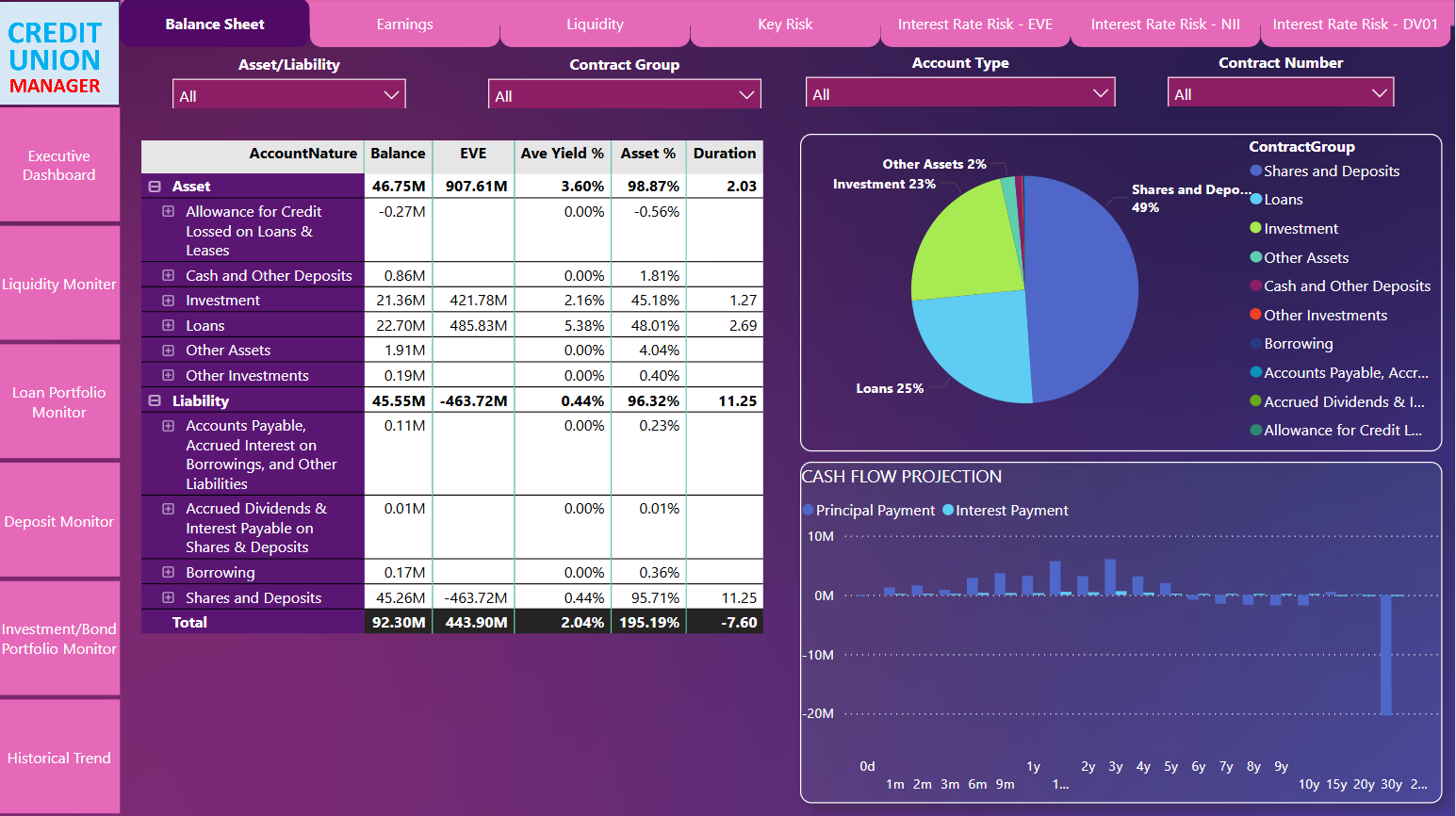

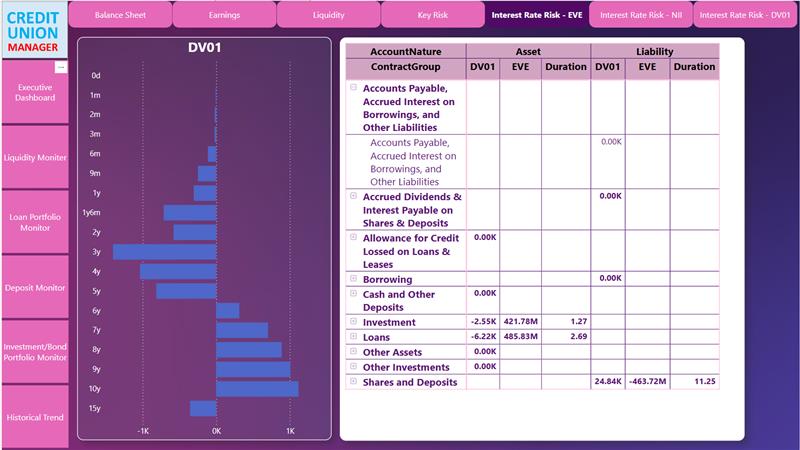

- Out-of-the box ALM functionalities and ALCO package

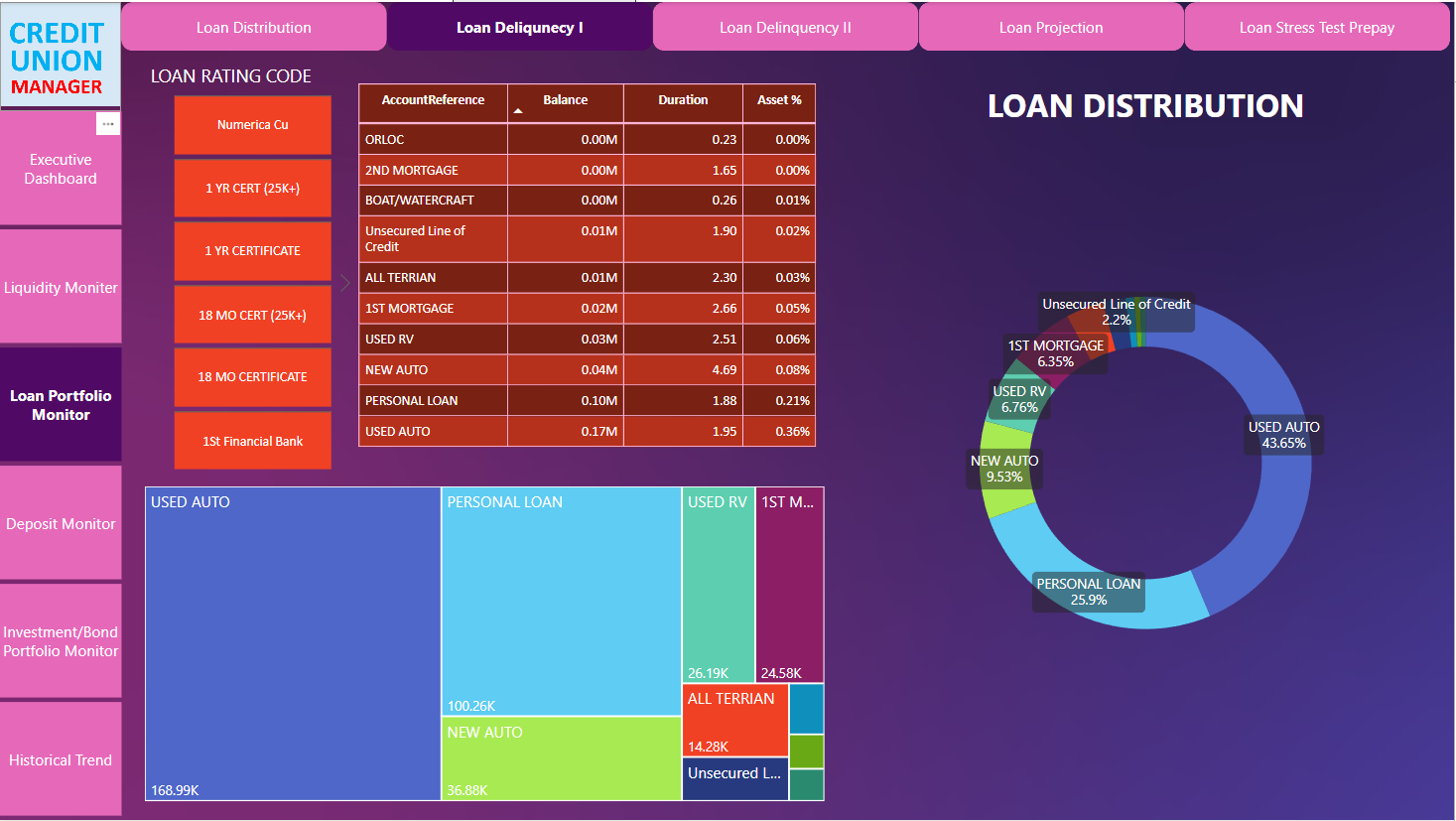

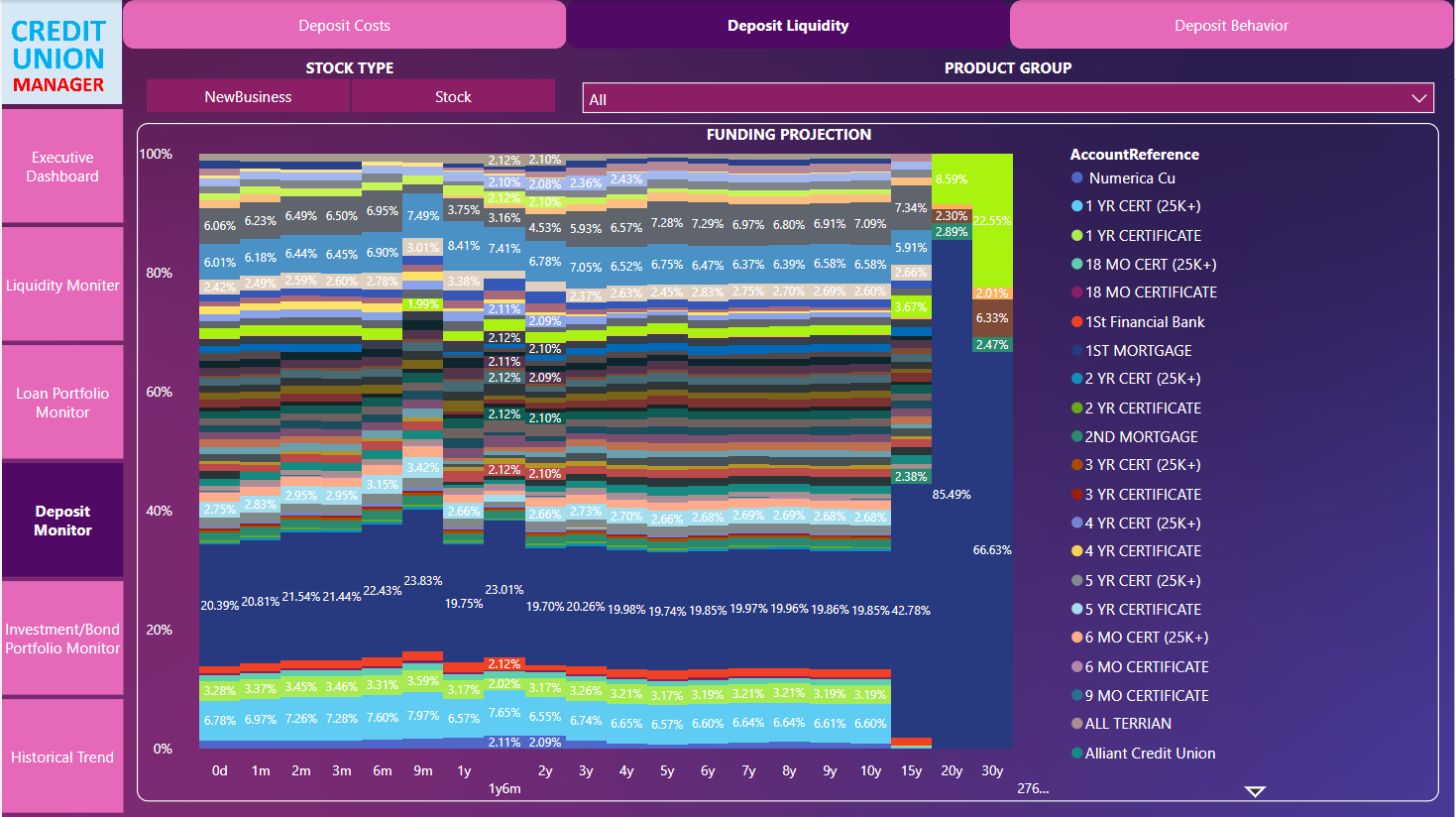

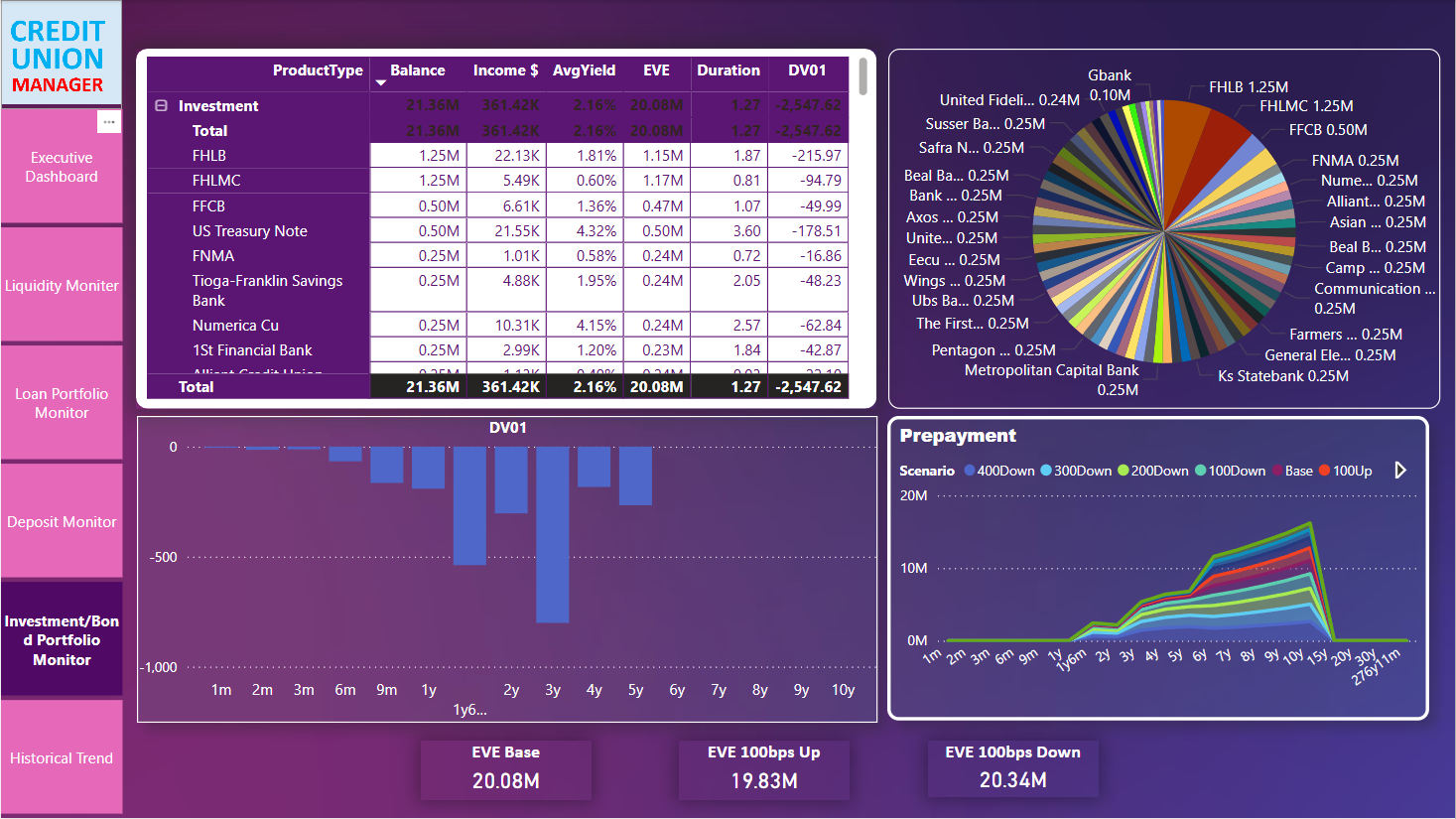

- Visual analytics to understand performance and drive decision-making

- Dynamic financial planning and budgeting

- Proactive Credit Risk Management

- Integrated Call Report Automation

- Deposit and Loan Rate Scanner

- Unlimited Scenario Analysis

- Comprehensive and Rigorous Audit Support

- Best-in-class Intuitive User Experience

Seamless

- Fully integrated with any core system and general ledger.

- Full user control over scenarios and stress tests.

- One click data upload on daily, weekly, monthly, and quarterly frequency.

- Onboarding and loan pooling, Q‑factors, and scenario definitions.

- Data from Fed, FRED and FFIEC built into solution.

Optimized

- Calculates universal set of predefined profitability, risk, credit performance, and risk parameters.

- Provides detailed breakdown at individual deposit, loan, member share, and investment security levels.

- Unlimited capability for pooling loans, deposits, and securities.

- Daily, weekly, monthly and quaterly uploads.

Intuitive

- Flexible three-dimensional dashboards with drill down capabilities.

- Built on Power BI to give intuitive and click through user experience.

- Out-of-the-box screens for effectiveness.

- Provides graphical and tabular breakdown.

- All data and inputs are readily accessible for full auditability.