CUINVEST

CUINVEST is a game-changer for credit unions aiming to optimize investment decisions and portfolio management. By automating the import of securities reports and providing integrated dashboards for analysis, it directly addresses inefficiencies that often plague smaller credit unions. Here’s how CUINVEST supports success using key financial metrics:

- Net Worth Ratio – By enhancing portfolio management, CUINVEST helps credit unions make strategic investment choices that bolster their financial strength.

- Return on Assets (ROA) – With real-time tracking and performance analysis, credit unions can maximize returns and optimize asset utilization.

- Delinquency Ratio – While primarily focused on securities, CUINVEST indirectly supports risk assessment by ensuring funds are strategically allocated in healthier investments.

- Loan-to-Share Ratio – Efficient management of securities portfolios ensures that liquidity remains balanced, allowing credit unions to maintain stable lending operations.

- Asset Growth Rate – Better-informed investment decisions lead to sustained asset growth, helping credit unions scale effectively.

- Membership Growth – Improved financial performance through smarter investments makes credit unions more attractive to potential members.

- Efficiency Ratio – Automating securities data integration reduces the administrative burden, improving operational efficiency.

- Net Interest Margin – CUINVEST enables credit unions to strategically manage interest-earning securities to maximize yields.

- Liquidity Ratio – With current performance visibility and what-if analysis, CUINVEST helps credit unions maintain optimal liquidity levels.

- Charge-Off Ratio – Proactive portfolio management reduces exposure to volatile assets that could lead to losses.

Investing in bonds and CDs several risks that entail complexities in risk management, accounting and reporting. These risks encompass valuation and asset liability mismatches from interest rate fluctuations, deterioration in issuer creditworthiness and potential for issuer default, and changes in market conditions.

These risks can be divided into three types that have overlapping dynamics: interest rate risk, credit risk, and market risk.

Interest Rate Risk

Bond prices have inverse relationships with movement in interest rates across maturities. When interest rates rise, the value of existing bonds with fixed interest rates tends to fall and vice versa.

Impact

Interest rate movements impact bonds in two ways: there is an inverse mathematical relationship between prices and rates that has greater impact on long-maturity bonds. In addition, if rates and associated interest coupons move higher, newly issued bonds become more attractive potentially leading to selling pressure on older, lower-yielding bonds, leading to market value declines and asset-liability mismatch.

Mitigation

Credit Unions should manage this risk by diversifying their bond holdings across the maturity spectrum, comprehensive asset-liability scenario analysis to identify portfolio sensitivities, and duration matching with their deposits and other liabilities.

Credit Risk

This is the risk that the creditworthiness of a bond issuer in a credit union deteriorates leading to potential default on its principal or interest payments. By and large credit unions do not take inordinate amount of credit risk by investing in corporate bonds. Their holdings comprise Agency Mortgage Bonds, US Treasury Bonds, Municipal Bonds, and CDs. However, credit union managements should observe and be prepared for any deterioration in issuer creditworthiness and potential defaults.

Impact

Deterioration in issuer creditworthiness can lead to valuation declines and Default can lead to losses for bondholders, potentially wiping out their entire investment.

Mitigation

Investors can assess credit risk by evaluating the issuer’s credit rating, considering credit spreads, and diversifying their investments across different issuers.

Market Risk

This is the risk of fluctuations in the market values of bonds in a credit union’s investment portfolio due to changes in broader market conditions, including economic factors, investor sentiment, and other factors that are not specific to an issuer or a bond.

Impact

Unfavorable market conditions can lead to declines in bond prices, even if the issuer is in good standing and interest rates are relatively stable.

Mitigation

This risk is mitigated by portfolio diversification, risk-averse asset allocation, and monitoring market conditions.

Liquidity Risk

The is the risk that investors may not be able to easily sell their bonds for a fair price that is close to book/carrying value.

Impact

Lack of liquidity can lead to losses, particularly for bonds with smaller trading volumes or those issued by less-established entities.

Mitigation

Credit Unions can mitigate liquidity risk by investing in highly liquid bonds, such as government bonds or those traded on well-established exchanges.

Other Risks

Call Risk

This is the risk that the bond issuer will redeem the bond before its maturity date, potentially depriving investors of future interest payments.

Reinvestment Risk

The risk that investors will be unable to reinvest coupon payments at the same rate of return as the original bond.

Systematic Risk

Risks that affect the entire bond market, such as changes in macroeconomic policies and/or geopolitical events.

CUINVEST DASHBOARDS

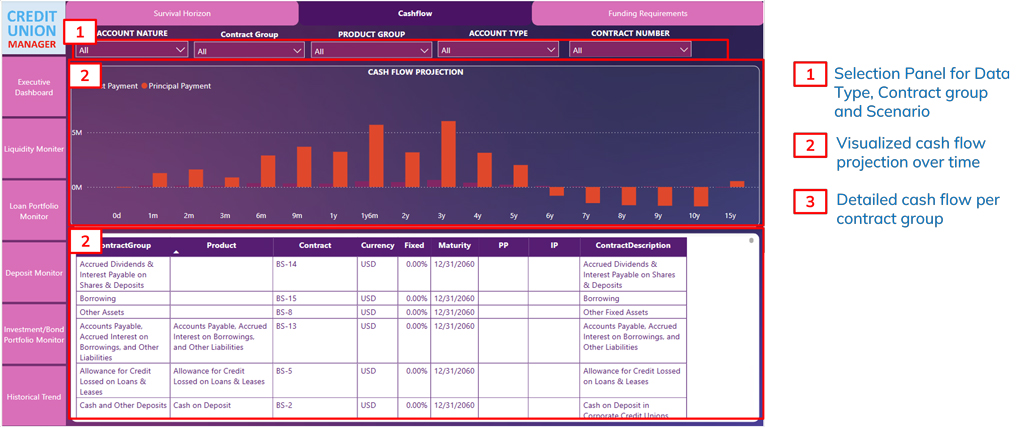

CUINVEST provides concurrent and accurate investment accounting reports at the individual security level with flexible drilldown dashboards with 10 years of historical and future analysis. .

CUINVEST eliminates the cumbersome work that has to be continually performed by Credit Union that entails manual accounting entries from pdf reports, and calculates the required risk and economic parameters to highest levels of accuracy. The results are presented in interactive, drillable AI-enabled dashboards that are customizable at institutional and user levels.

The reports are constructed for day-to-day risk management, what-if analyses, and board and examiner reporting. The results directly feed into CUMAN’s NCUA Call Report interface.

Investment/Bond Portfolio Monitor Dashboard

Executive summary

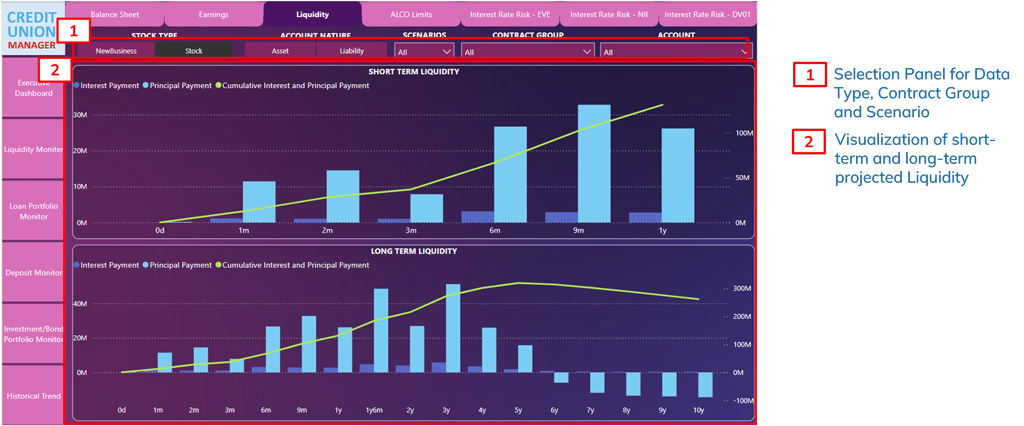

Liquidity

Click here to view illustrative live dashboards

Management Reports

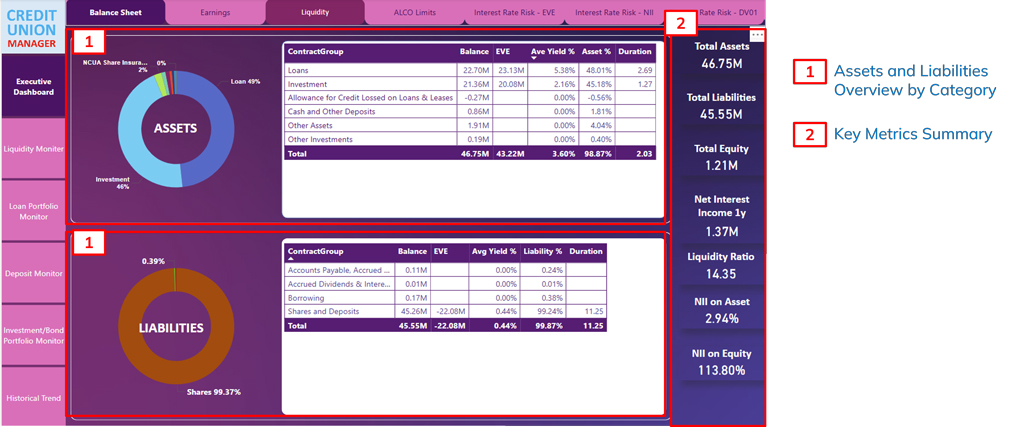

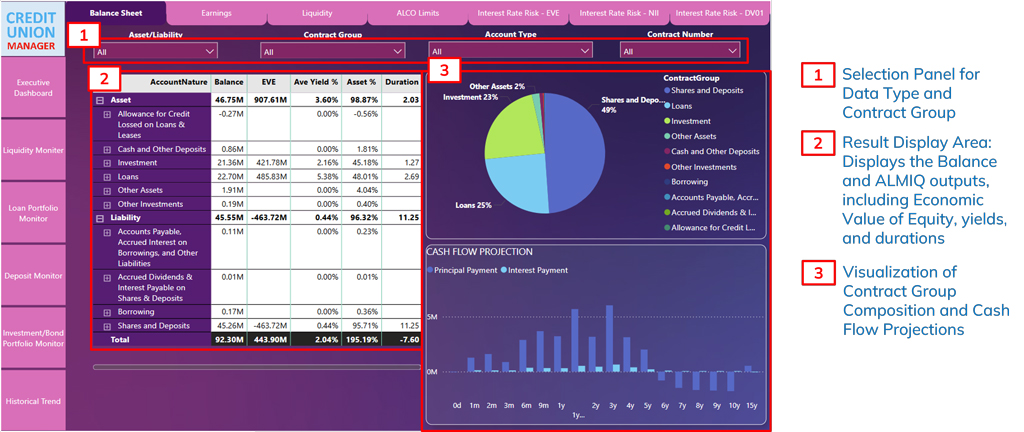

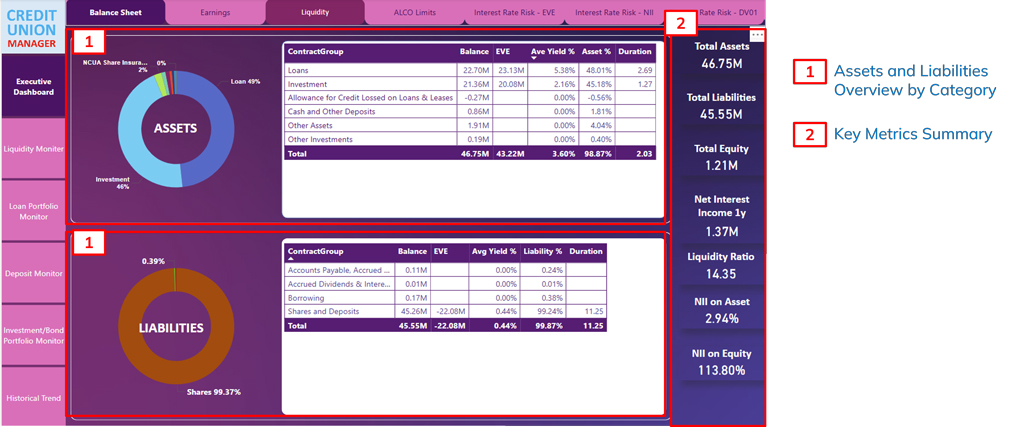

Balance Sheet Dashboard

- Maturity Distribution by Year of Maturity

- Maturities by Month

- Cash Flow Reconciliation

- Securities Callable Within 90 Days

- Pledge Report for individual securities and maturities

- Unpledged Report

- Structured Note Listing

- Municipal Summary by Rating

Board Dashboard and Reports

Executive Dashboard

- Portfolio distribution and analysis at the individual security level.

- Maturity Distribution Summary

- Portfolio Transactions

Regulatory Reports

Liquidity Monitor Dashboard

- Schedule RC-B Securities

- Schedule RC-K: Quarterly Averages

- Schedule RCR: Risk-Based Capital

Accounting Reports

Investment/Bond Portfolio Monitor Dashboard

- Accrued Interest Reconciliation

- Book Value Amortization and Accretion Reconciliation

- Payment Reconciliation

- Maturity and Coupon Schedule

- Year-to-Date Income Summary

- Unrealized Gains/Losses Adjustments and Transfer