CURISK

Credit unions today face a complex risk landscape that continues to evolve with technological advancements, regulatory changes, and shifting economic conditions. Here are some of the most pressing financial, credit, and operational risks they must navigate:

Financial Market Risk

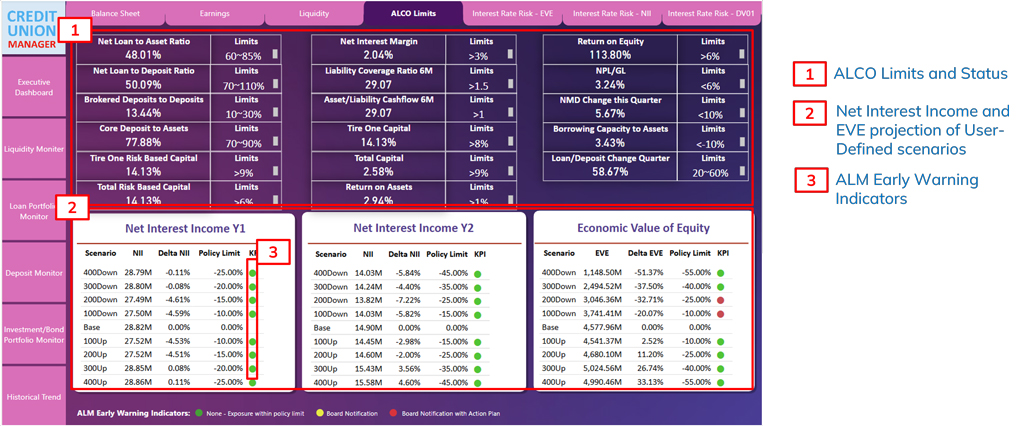

- Interest Rate Risk: Fluctuations in interest rates can impact loan profitability and deposit costs, affecting overall financial stability.

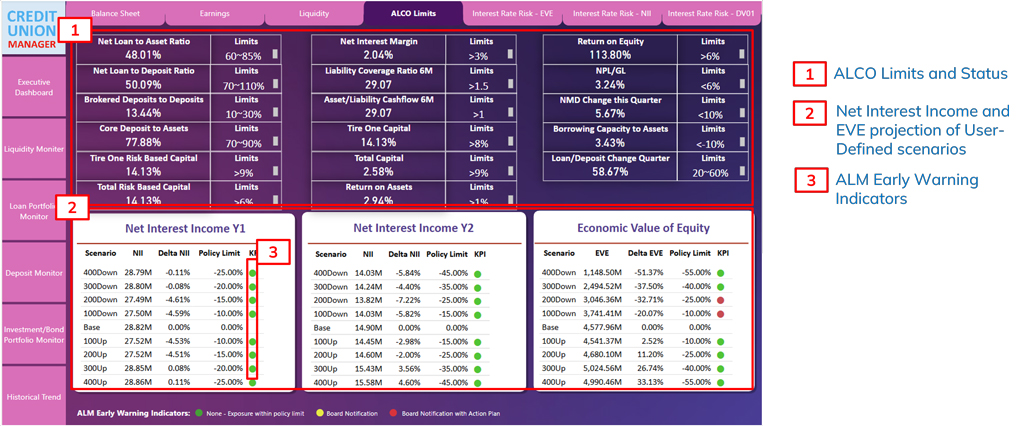

Policy Limits Dashboard

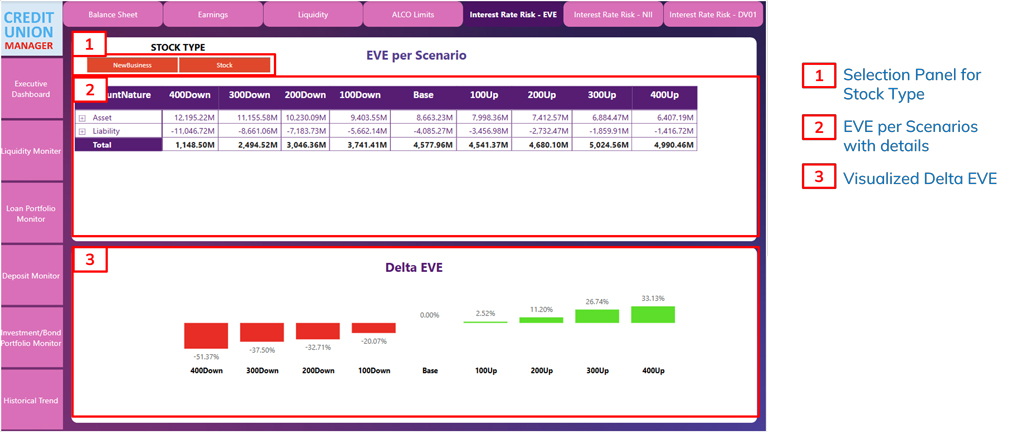

Interest Rate Risk Dashboard

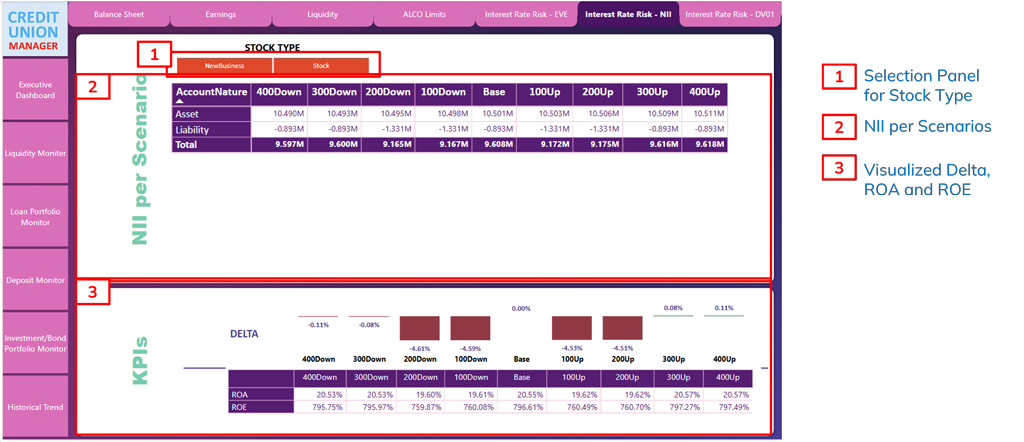

Interest Rate Risk Dashboard

- Liquidity Risk: Credit unions must ensure they have sufficient funds to meet member withdrawals and lending demands, especially in times of economic uncertainty.

Liquidity Monitor Dashboard

- Peer Comparison: Larger financial institutions and fintech companies are investing heavily in technology, making it harder for credit unions to compete.

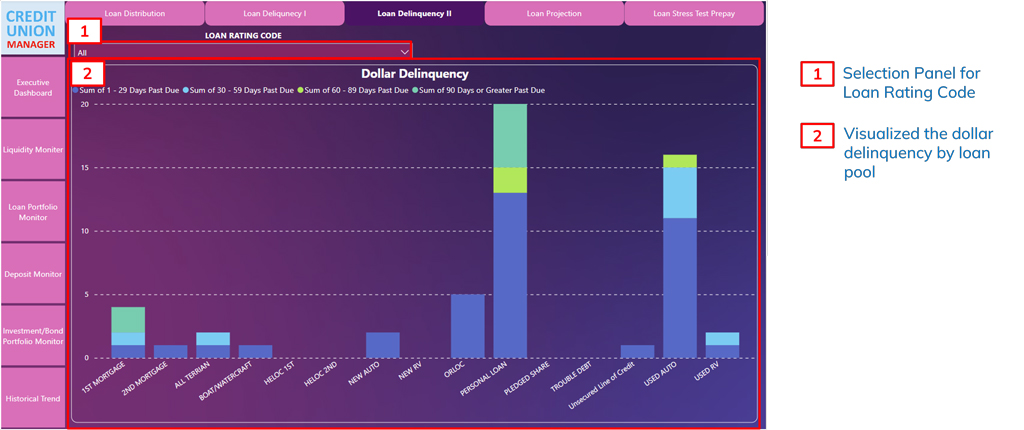

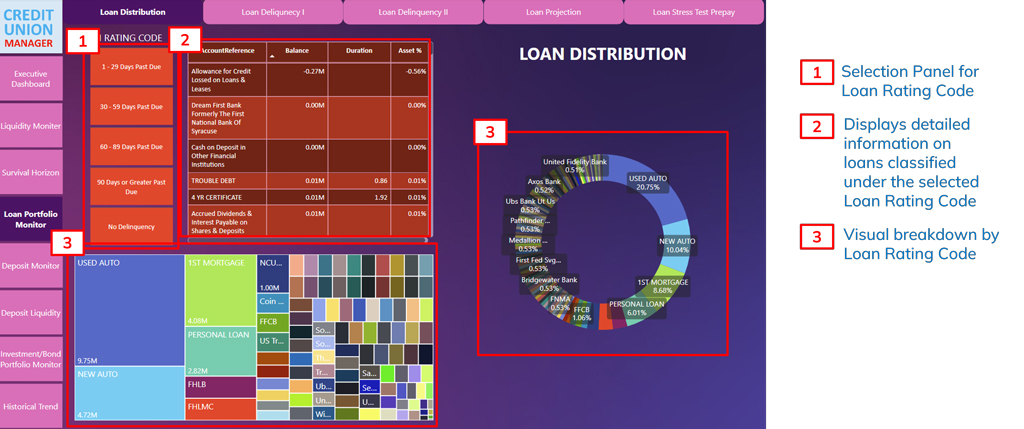

Credit Risk

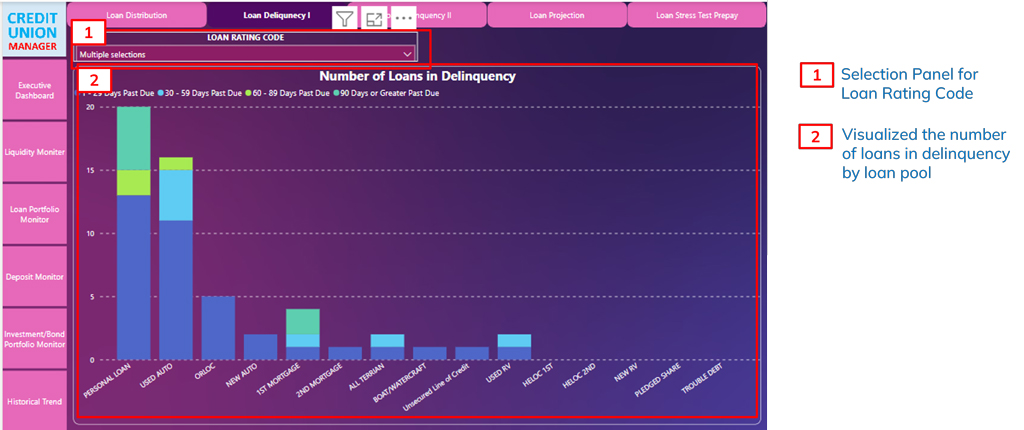

- Loan Delinquencies & (Historical) Charge-Offs: Rising financial challenges for members can lead to higher loan defaults, impacting credit union balance sheets.

Loan Portfolio Monitor Dashboard

Loan Portfolio Monitor Dashboard

- Consumer Debt Burdens: Many members are juggling mortgages, auto loans, credit cards, and student loans, increasing the risk of financial distress.

Loan Portfolio Monitor Dashboard

- Regulatory Compliance: Stricter lending regulations require credit unions to maintain rigorous underwriting standards and risk assessments.

Policy Limits Dashboard

Operational Risk

- Cybersecurity Threats: The financial sector is a prime target for cyberattacks, including ransomware, phishing, and data breaches. The cost of a data breach for financial institutions averages $5.9 million.

- Technology & AI Risks: Increased reliance on AI and automation introduces new risks related to data privacy, regulatory compliance, and operational efficiency.

- Fraud & Identity Theft: Fraudulent activities continue to rise, requiring credit unions to enhance security measures and fraud detection capabilities.

Reputational Risk

- Member Trust & Public Perception: Negative publicity, poor service, or compliance failures can erode member confidence.

- Regulatory Scrutiny: Non-compliance with consumer protection laws can damage credibility.

- Cybersecurity Breaches: Data leaks or fraud incidents can severely impact reputation and member retention.

Concentration Risk

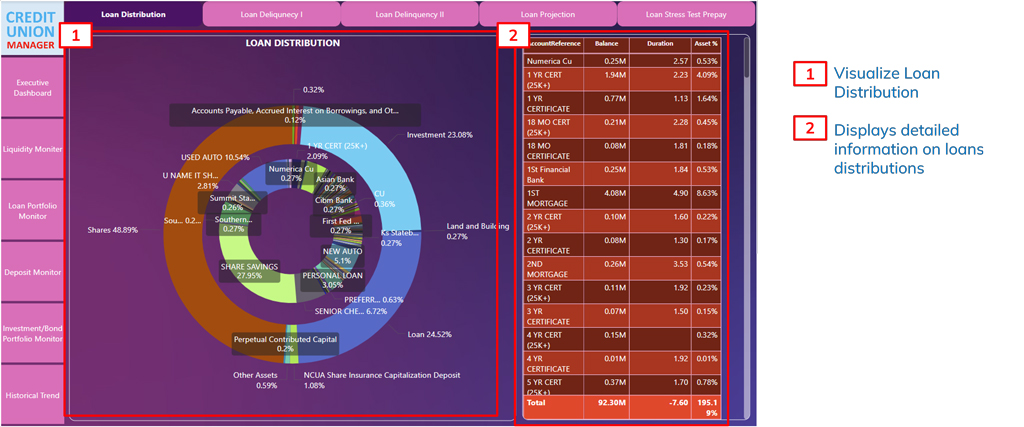

- Loan Portfolio Concentration: Overexposure to a single asset class (e.g., auto loans or mortgages) can increase vulnerability to market downturns.

Loan Portfolio Dashboard

- Geographic Concentration: Credit unions heavily reliant on a specific region may face economic instability if local industries decline.

- Membership Demographics: A narrow member base (e.g., industry-specific credit unions) can limit growth and diversification.

- Geographical Risks

- Regional Economic Shifts: Credit unions operating in areas with declining industries or population loss may struggle with loan demand and deposit growth.

- Natural Disasters: Credit unions in disaster-prone regions must have contingency plans for operational disruptions.

- Regulatory Variability: State-specific regulations can create compliance challenges for multi-state credit unions.

- To stay ahead, credit unions must adopt proactive risk management strategies, invest in cybersecurity, and leverage data-driven insights to anticipate financial trends. What specific risks are most concerning for your credit union?